This quarter once again demonstrated Sportradar’s ability to generate consistent and durable growth, strong operating momentum, and increasing profitability across our business. The sustained operating results that we continue to deliver underscore the resilience of our global business and the increasing value we are providing to clients, partners, and shareholders. Today, I’d like to take you behind the numbers and show how we are further positioning the company for sustained long-term performance.

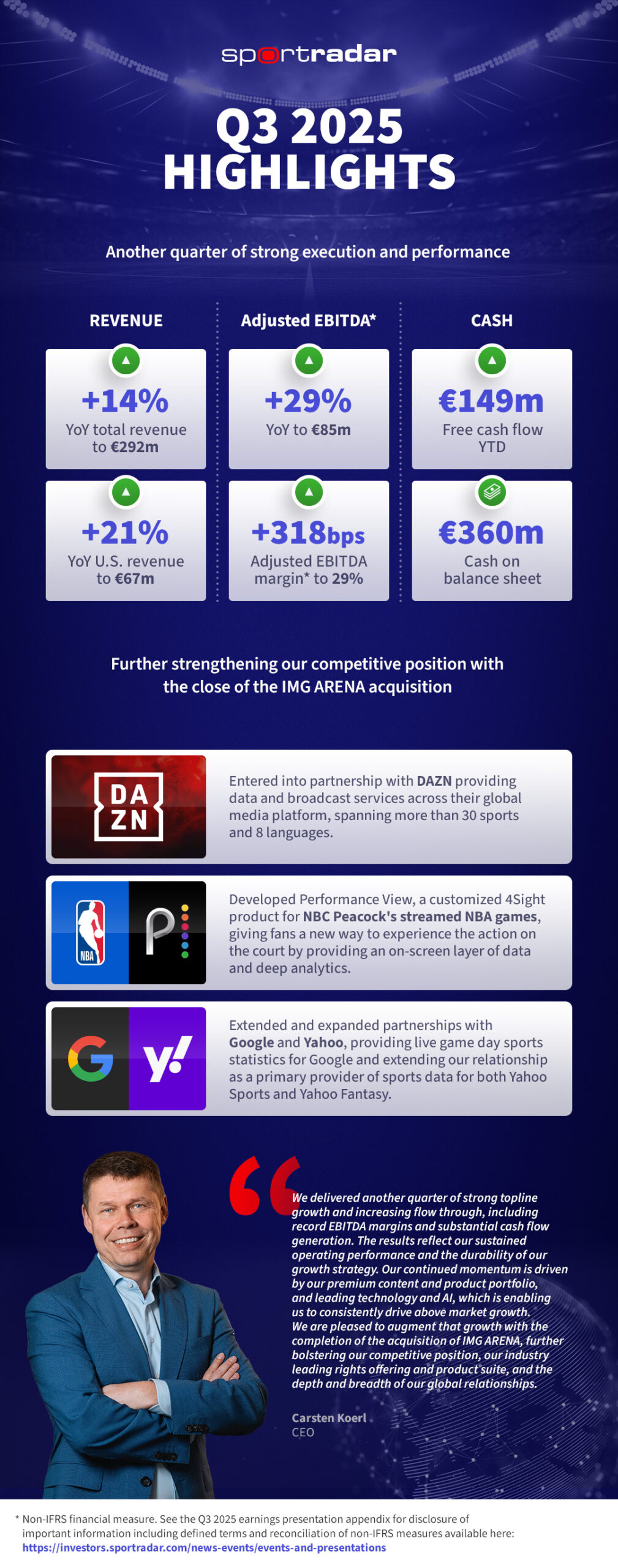

Sportradar’s differentiated position at the heart of the sports ecosystem where leagues, media, and operators converge remains a core competitive advantage. By scaling our advanced technology solutions, expanding our premium content portfolio, and deepening trusted partnerships worldwide, we drove Q3 revenue of $292 million, representing 14% year-on-year growth despite foreign currency headwinds. Our continued focus on operational discipline and scalable growth translated into adjusted EBITDA of $85 million, an increase of 29%, resulting in significant operating margin expansion and robust free cash flow generation in the quarter.

Closing on IMG ARENA further strengthens our leading sports rights portfolio and unlocks new commercial opportunities. The acquired portfolio encompasses strategic relationships with over 70 rightsholders, delivering approximately 38,000 official data events and 29,000 streaming events across 14 global sports on six continents. The acquisition is expected to accelerate revenue, adjusted EBITDA, and free cash flow growth while being accretive to adjusted EBITDA margins and free cash flow conversion.

We are also raising our 2025 full year guidance, to incorporate the closing of our IMG ARENA acquisition, and now expect revenue of at least €1,290 million, or 17% growth, and Adjusted EBITDA of at least €290 million, or 30% growth. Given the strong momentum we see going forward and the opportunity to create significant shareholder value, our Board of Directors authorized increasing our share repurchase program by $100 million, raising the total program size to $300 million.

We are executing against the strategic roadmap laid out earlier this year, focused on delivering more value for our clients and partners through innovation in data-driven fan engagement and betting products; investing in strong growth drivers such as AI automation and product enhancements, while maintaining disciplined cost management to drive continued profitability; and positioning the company for future growth with a strong balance sheet that supports targeted expansion and selective M&A.

We enter the final stretch of the year with focus and momentum. The global sports market continues to evolve rapidly, and Sportradar is uniquely positioned to lead as demand grows for deeper insights, more immersive experiences, and trusted technology at scale.

Craig Felenstein, CFO